As the year progresses, C-level executives continue to operate in a volatile and complex environment. With ongoing uncertainty around economic factors, like tariffs and inflation – along with rapid technological change – how are C-suite leaders guiding their organizations through this tumultuous year and planning for 2026?

We asked C-level executives across our communities about how geopolitical and economic factors were impacting their priorities in April 2025. We followed up approximately six months later to learn if their sentiments had changed. Here, we share responses from 740 C-level executives to our August survey and compare how executives’ views have evolved over time.

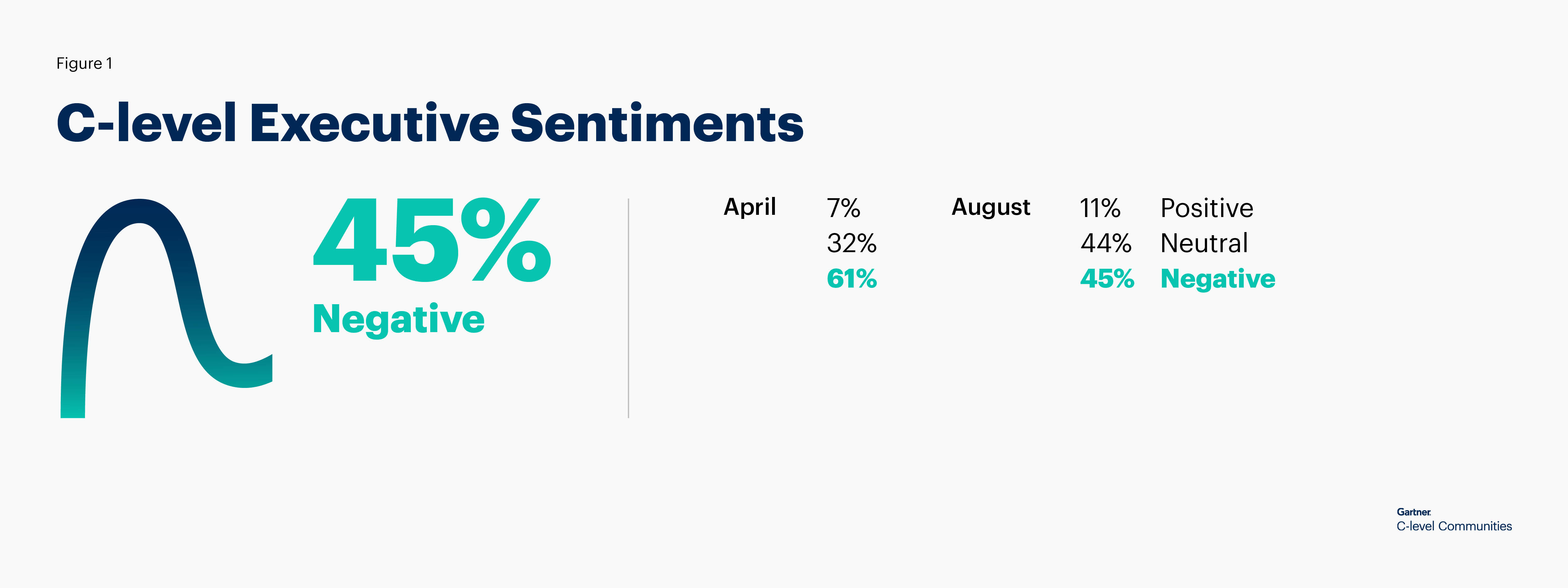

Sentiments on the Current Geopolitical and Economic Climate

Overall, C-level executives are more neutral and less negative about the geopolitical and economic environment as it relates to their organization than they were earlier this year. Executives responding that they feel positively grew only 4%, but the number reporting that their sentiments were negative declined 16% since April. The number of respondents selecting neutral also grew 12%.

There are some minor regional variations in sentiments with leaders in Europe, the Middle East, and Africa (EMEA) and Asia Pacific (APAC) reporting a slightly more negative point of view than their North American peers. Forty-nine percent of EMEA and APAC executives have a negative view of the current climate, while 42% are neutral and 10% are positive. Forty-three percent of leaders in North America report a negative view, while 45% are neutral and 13% are positive.

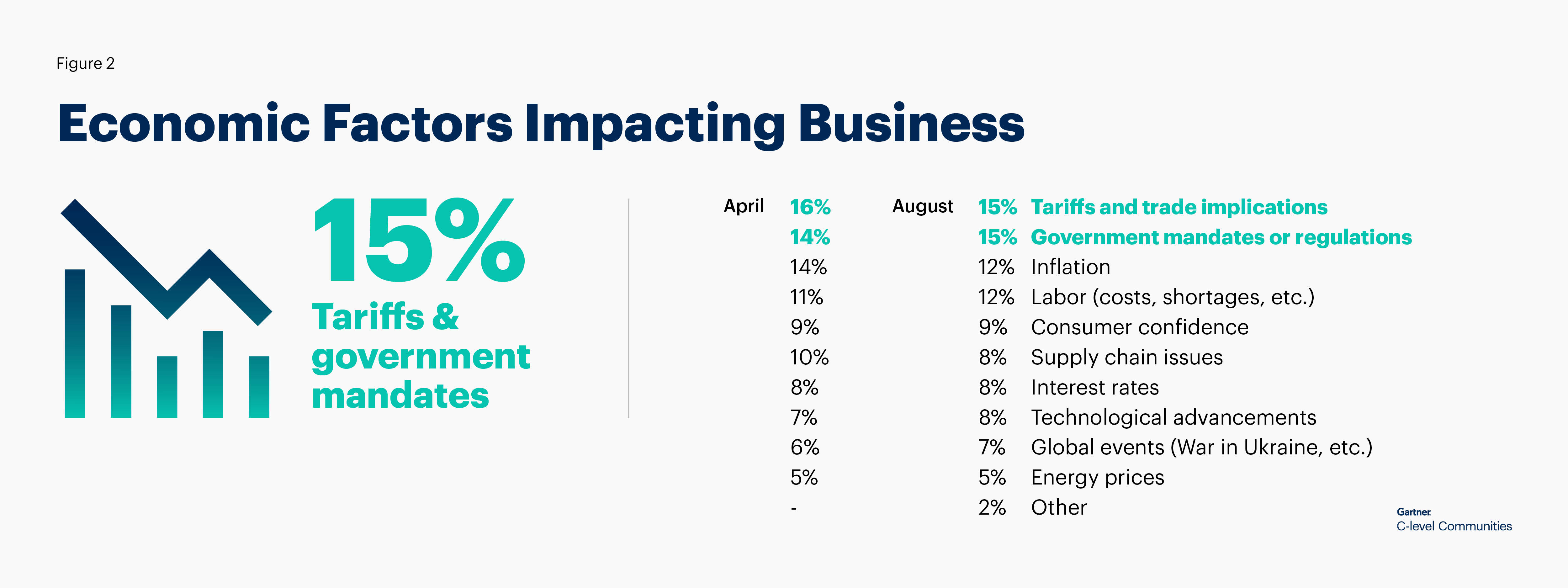

Economic Factors Impacting Their Organizations

In terms of the economic factors that are impacting their business, C-level executives indicate that they are mostly the same ones that they cited in April. There were only slight differences in the percentages of respondents who selected each factor, with tariffs and government mandates still topping the list, both selected by 15% of executives, followed by inflation and labor concerns, chosen by 12% for each answer.

In the comments for “Other,” executives report that uncertainty in economic and government policy is a factor, with one writing that “uncertainty is leading to lack of decisions or commitments internally and with partners.” Another theme in the comments was cost pressures, including “cost of living,” “housing costs,” and “increased cloud costs.” Finally, executives mentioned talent challenges, noting that immigration-related issues, “access to talent,” and “travel visas” were constraints for their business.

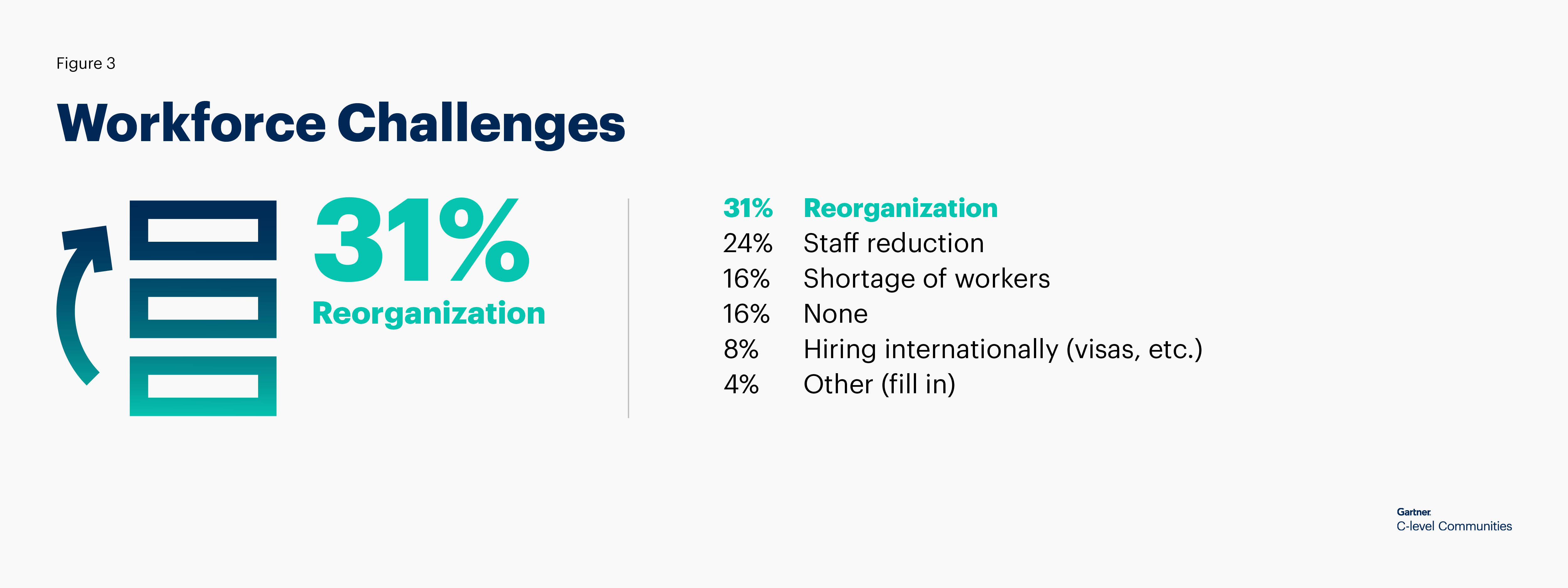

Workforce Issues Impacting Organizations

In response to a new question in the survey about whether or not their organizations are facing workforce challenges, 31% of executives report they are reorganizing, and 24% say they are reducing staff.

Some of the responses for “Other” labor concerns include talent acquisition and gaps in skills, with executives commenting it is “difficult to recruit for certain roles,” and they have a “technical skill shortage.” Budget constraints, return to office policies, automation, and outsourcing are also mentioned as other workforce issues.

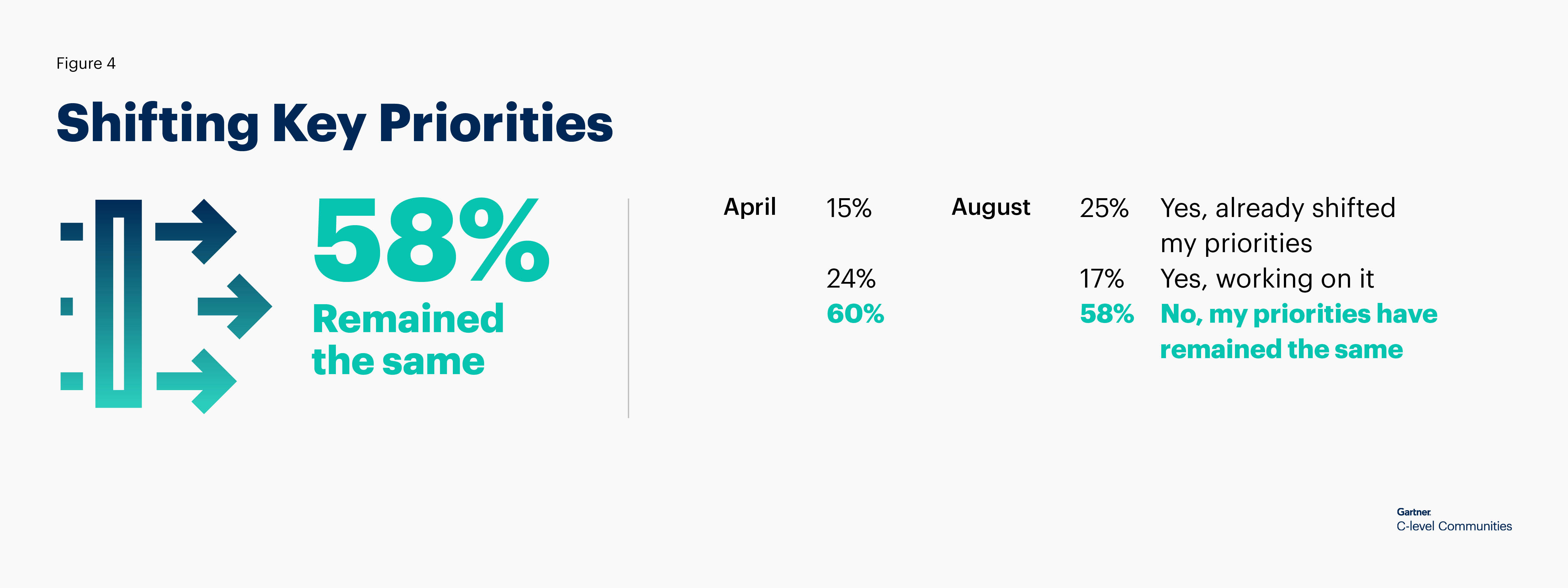

Shifting Strategic Priorities in Response to Challenges

C-level executives who were reprioritizing in April appear to have done so, as the 24% of leaders who were working on shifting their priorities is down to 17%, and those that have already changed their focus areas increased from 15% to 25%. The number of executives reporting that their key priorities remained the same is nearly the same as it was in April.

In terms of what priorities they are working on now, C-suite leaders share that they are focusing on cost reductions and creating efficiencies, AI adoption and general digital transformation, and workforce planning and organizational restructuring.

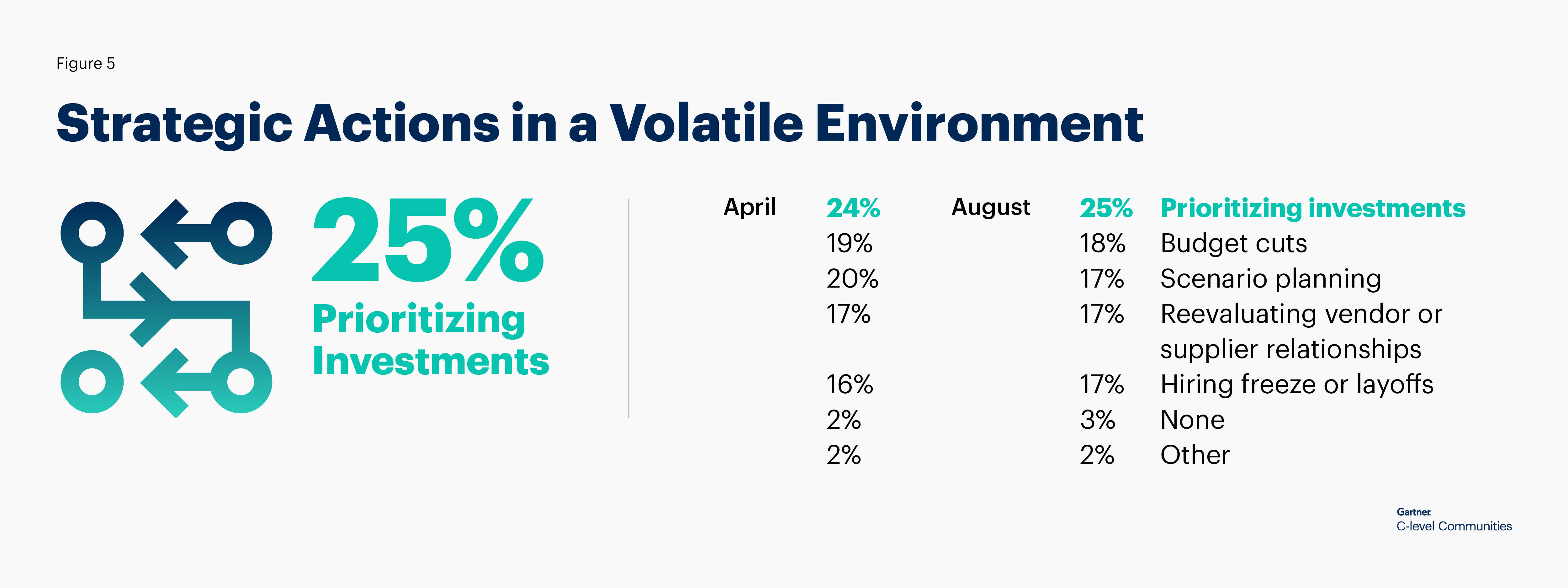

Strategies to Navigate Economic Uncertainty

Some specific actions C-level executives are taking to manage through a continued volatile environment include prioritizing investments and budget cuts, cited by 25% and 18% of leaders respectively. Their responses between the April and August surveys are nearly identical.

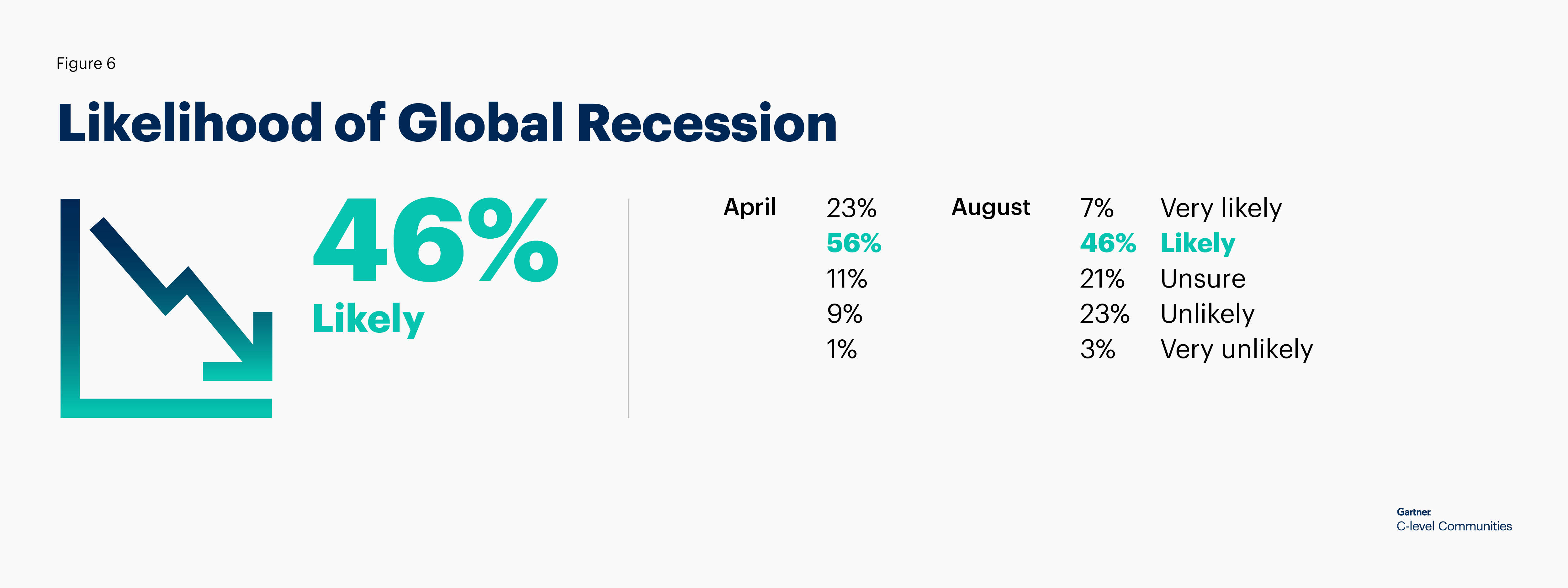

Current Thinking on the Possibility of a Recession

C-suite leaders have changed their thinking about the likelihood of a global recession since April, when a combined 79% said a recession was very likely (23%) or likely (56%). That percentage has dropped to 53% who believe a recession is very likely (7%) or likely (46%). The number of executives who are unsure has increased from 11% to 21%, and the number who now believe a recession is unlikely has grown from 9% to 23%.

Outlook for the Future

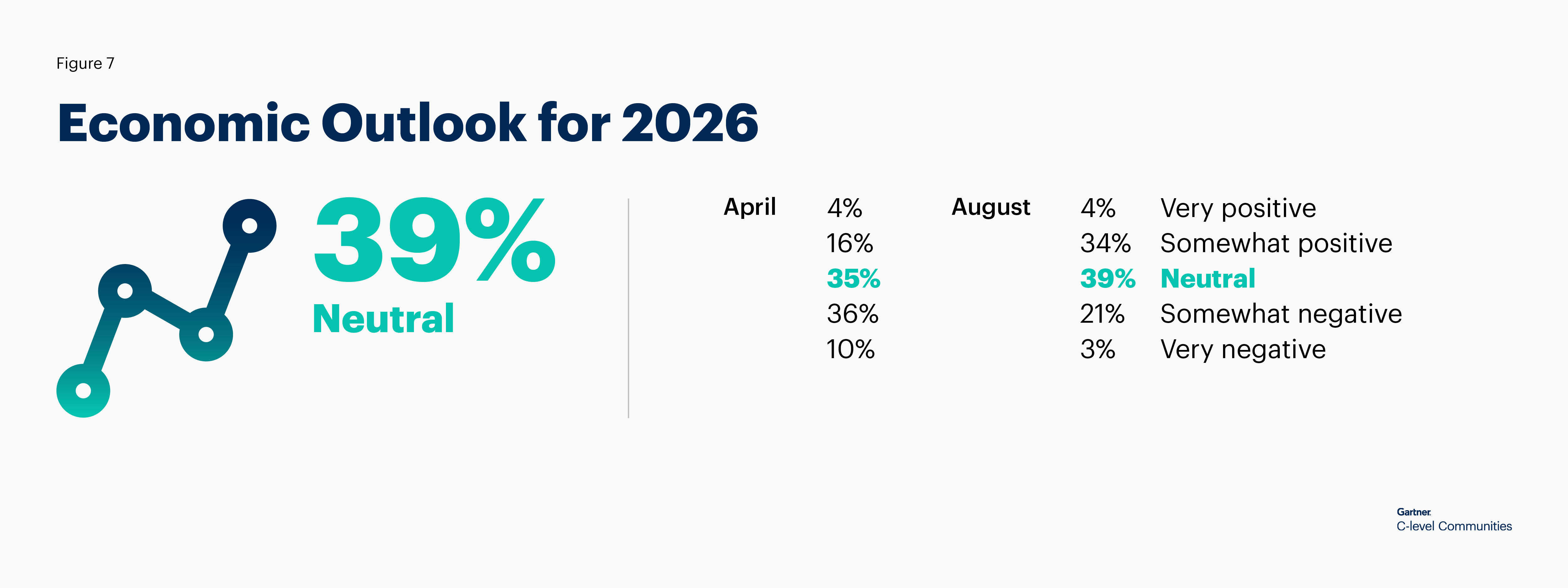

The positive outlook from C-level executives has also increased when they are asked about their thoughts on the economy going into 2026. The highest percentage of respondents shifted from somewhat negative in April (36%) to neutral in August (39%). Executives saying they are somewhat positive grew from 16% to 34% in that time period.

Planning and Strategizing for 2026

Acknowledging the ongoing volatility, we asked C-level executives how they are planning for 2026 in the current environment. Here is a selection of their responses:

Adopt a dynamic, resilient, and forward-thinking approach. The focus must be on agility and foresight, moving beyond rigid, long-term plans.

– CIO Community Member

Building resilience through designing for change, rather than predicting the future, using data-driven analytics, maintaining customer centricity, and scenario based planning.

– CHRO Community Member

We continue to ground ourselves in our values and goals, while making tactical corrections to spending and investment.

– CFO Community Member

Get back to basics. Focus on core tools. Change culture as that does not take a large budget.

– CISO Community Member

By continuing to focus on mid-range strategic priorities and minimizing distractions when possible.

– CDAO Community Member

If you are a C-level executive leading your organization through economic uncertainty, consider joining Gartner C-level Communities to meet and discuss challenges and opportunities with your peers. If you are already a member, sign in to the app to find your community’s upcoming gatherings.

Based on 740 responses to Gartner C-level Communities’ Community Pulse Survey, August 2025.

Join a Community

Find your local community and explore the benefits of becoming a member.